Managers vs. Markets

Submitted by Grunden Financial Advisory, Inc on August 20th, 2010Proponents of active management believe that skilled managers can outperform the financial markets through security selection, market timing, and other efforts based on prediction. While the promise of above-market returns is alluring, investors must face the reality that as a group, US-based active managers do not consistently deliver on this promise, according to research provided by Standard & Poor’s.

S&P Indices publishes a semi-annual scorecard that compares the performance of actively managed mutual funds to S&P benchmarks. Known as the SPIVA scorecard [1], the report analyzes the returns of US-based equity and fixed income managers investing in the US, international, and emerging markets. The managers’ returns come from the CRSP Survivor-Bias-Free US Mutual Fund Database, and the managers are grouped according to their Lipper style categories [2].

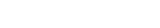

The graph below features fund categories from the most recent SPIVA scorecard—all US equity funds, international funds, emerging market funds, and global fixed income funds—and shows the percentage of active managers that were outperformed by the respective S&P Indices in one-, three-, and five-year periods. These are only four of thirty-five equity and fixed income fund categories. But a deeper analysis confirms that the active manager universe usually fails to beat the market benchmarks over longer time horizons. Underperformance of active strategies is particularly strong in the international and emerging markets, where trading costs and other market frictions tend to be higher.

Over the last five years, about 60% of actively managed large cap US equity funds have failed to beat the S&P 500; 77% of mid cap funds have failed to beat the S&P 400; and two-thirds of the small cap manager universe have failed to outperform the S&P Small Cap 600 Index. Furthermore, across the thirteen fixed income fund categories, all but one experienced at least a 70% rate of underperformance over five years.

In 2009, active funds experienced more success over a one-year period, and proponents typically highlight those results in the SPIVA scorecard. However, one-year results are not consistently strong from year to year, and investors should not draw conclusions from short-term results. Over three- and five-year periods, most fund categories have not outperformed their respective benchmarks.

This poor track record appears in other research, as indicated in the graph below. This study compared the same actively managed funds in the CRSP database to the Russell benchmarks and showed similar results over the three- and five-year periods. Over the past five years, about 65% of all US equity managers failed to outperform their respective Russell Indexes, and 84% of fixed income managers failed to beat their respective Barclays Capital Indices.

Of course, the results of these studies will fluctuate over time, and a majority of funds in a given category might outperform over the short term. But the message is clear: As a group, actively managed funds often struggle to add value relative to an appropriate benchmark—and the longer the time horizon, the greater the challenge for active managers to maintain a winning track record.